The world's leading pricing and profitability

management software is here:

Click the play button to find out more.

The world's leading pricing and profitability

management software is here:

Click the play button to find out more.

Driving Bank Profitability

The modern bank needs a different approach

for managing pricing and profitability

Are you tired of managing profitability through a “rear-view mirror”?

Are you still pricing for relationship profitability on manual spreadsheets — and juggling data from multiple systems?

Are you struggling to modify your rates, products, and pricing strategies in real time?

With bank ROE dropping, and competitors using the latest automation technology, you can’t afford to

continue without a powerful solution.

It’s time to digitally transform the way you operate to drive superior performance.

The ESG Game Changer

Incorporating ‘actionable’ client ESG intelligence into financially sensitive decisions is a matter of urgency for banks.

DPXesg extracts actionable ESG information from internal, traditional, and

alternative 3rd party data sources to drive structured and focused

ESG data collection, direct from the client.

DPX combines Pricing, Rates, Product/Profitability

Management and ESG Management to give your bank state-of-the-art capabilities to grow your profit

DPX, the next generation of DealPoint, is uniquely tailored to your bank’s specific models, products and processes.

The solution integrates:

Pricing

Management

Structure and price deals with a comprehensive toolset to optimize customer relationship profit

Rates & Product Management

Dynamically create and modify rates, rules, fees, and costs to respond to changing market demands

Profitability Management

Gain a real-time comprehensive view of past and future profitability at the relationship and portfolio level

ESG

Management

Transparent, exhaustive and actionable quantification of a client’s ESG risks and opportunities at the point of pricing

Brilliance solutions have been delivered in 50 countries to 25,000+ bank relationship managers

Our 15+ years of experience has been consolidated into DPX, our 4th generation cloud-native platform.

Proven results

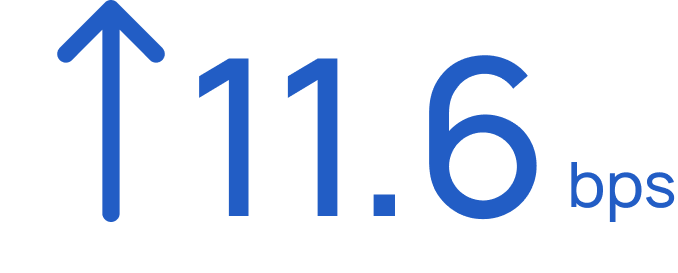

Average Deal Margin

Deal Volume

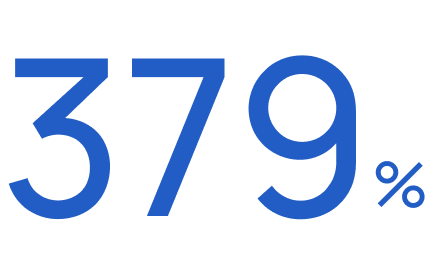

Return on Investment

Portfolio Management Efficiency

"DPX streamlines our commercial processes, which is extremely important to service our clients better and faster. Working with a partner like Brilliance who really knows what they're talking about and are really specialized in bank digital pricing is crucial to our transformation program's success."

Lissy Smit

Global Head of Loan Product Group

Our client snapshot

Brilliance Financial Technology driving bank profitability