By Mark Gu Chen, Head of Product at Brilliance Financial Technology, and Riyaz Nakhooda, VP of Strategic Partnerships at Accern

Events like deforestation, climate change, and the actions of businesses are all over the news. This awareness is causing more consumers to seek out businesses with positive Environmental, Social and Governance (ESG) practices. Businesses who can prove their positive ESG impact will likely have the advantage over non-ESG-compliant competitors.

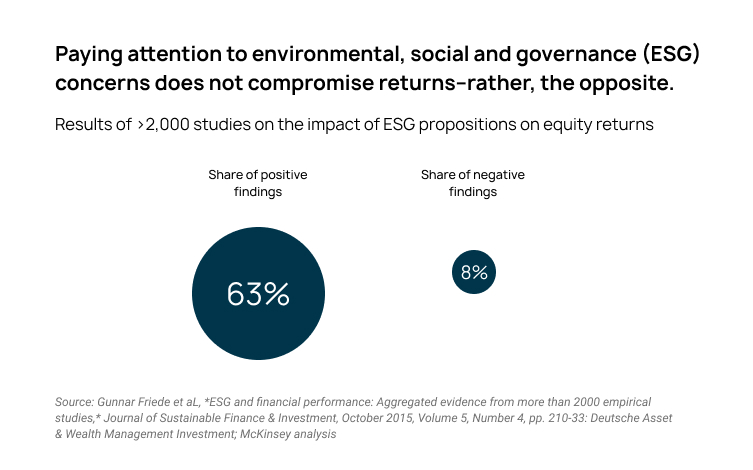

According to a study by S&P Global, how a company performs on sustainability factors relevant to their industry can be an important determinant of financial performance. The diagram from McKinsey above shows that firms that pay attention to ESG concerns have a positive return on equity. Firms with poor ESG practices are risky, especially those operating in non-sustainable industries. It’s no wonder that banks are increasingly evaluating a company’s ESG practices in their investment, risk management, and lending activities.

In many banks, ESG is reviewed as part of the relationship management or credit approval process. In this article, we’ll explore why this is problematic and propose why ESG should be in the pricing process.

Real-time bank pricing decisions on the frontlines

Until recently, pricing decisions for commercial lending were almost exclusively made by specialists in the middle and back office. The complex nature of commercial deals, the varying profitability models, their associated credit risk data, as well as the non-linear business processes were often cited as reasons why real-time pricing was not possible for the front line.

Today, however, almost every bank’s digital transformation program includes pricing and profitability analysis for bankers as a key part of a banker’s journey, often at great effort and cost.

Why are banks willing to invest in this area now? Having worked closely with many Tier 1 and 2 banks across the world, we at Brilliance know that bringing pricing decisions to the frontline not only improves the bank’s operational efficiency, but also helps the bank strategically. For example, banks can: ensure consistent pricing discipline across the organization, promote holistic relationship profitability with future cross-sell opportunities, and allow the frontline to structure competitive and profitable deals with the latest data in real-time.

How banks can apply this lesson to ESG

It’s absolutely crucial for banks to use the latest available financial and credit risk data. Similarly, banks should use the most current ESG information to structure the best price offer to customers, based on the risk the bank is taking.

Since ESG is dynamic , bankers need access to real-time ESG data. ESG data needs to be considered as part of the initial pricing negotiations with customers well before underwriting and origination. With Artificial Intelligence (AI) / Machine Learning (ML) and cloud computing, structured ESG data based on a wide array of sources can be seamlessly presented to the frontline in real-time as part of the pricing process.

Timely ESG data, whether positive or negative, will help bankers decide on price reductions or premiums for certain industries. Banks can easily deploy an ESG-based pricing strategy to reward customers who meet certain ESG criteria.

Learn more about the launch of the Brilliance DPXesg service.

Where ESG doesn’t belong in banking

CRM: Some banks feel that ESG should be managed as part of the relationship management process. As such, the Client Relationship Management (CRM) platform would be the natural place to maintain ESG information.

While it’s true that a great banker pays attention to all of his/her relationships all the time, in reality, most bankers will only pay close attention to a relationship when there’s an opportunity. There just isn’t enough time, and sales incentives are not designed to allow bankers to look at ESG activities for all of their relationships. However, when there is a new opportunity, pricing is often the first point of discussion. So if ESG can be seamlessly incorporated into the deal structuring and pricing process, bankers will naturally pay close attention, because it will be an important variable that impacts the success of the opportunity.

Origination: Since credit approval is the control gate for deal approval, some banks feel it makes sense to combine ESG as part of credit decisioning.

While reviewing ESG as part of the credit approval process can help banks avoid bad customers, banks will miss the opportunity to offer the right product and set competitive pricing in the initial commercial engagement process. But if ESG is in the deal structuring and pricing process, the bank will not only avoid bad customers — the bank will also gain the ability to develop sophisticated strategy based on the ESG of the relationships, shape the type of product offered, the special terms of those products, and pricing outcomes.

Considerations for building your bank’s ESG assessment framework

While the reasons to incorporate ESG into lending decisions should now be clear, there are challenges and solutions to bring the ESG impact to the frontline.

Banks must first consider the appropriate ESG lens they want to apply to observe a company’s ESG practices and its impact on society and the environment. This may include using industry frameworks such as MSCI, SASB, SDG or internal ratings frameworks they’ve developed. Furthermore, it’s equally important to assess a company’s stance on ESG controversies such as racial injustice, mining incidents and other ongoing controversies.

Once an appropriate lens is determined, organizations must gather the correct data to support an accurate ESG analysis. It’s often difficult to get granular, underlying data for individual companies to support an ESG assessment. This is due to an inconsistency in the requirements of how organizations are to publish their ESG information, as well as the way the information is typically spread across various reports. The data issue is further compounded due to the fact that many companies don’t have the resources to provide adequate ESG information, since they don’t have dedicated sustainability teams in the first place.

Additionally, many organizations prefer to not disclose issues that may impact their reputation. This is often seen with social issues like diversity, where companies are reluctant to share demographics in their data (and for some organizations, sharing that information can even be illegal). In fact, S&P states that only about a third of the companies assessed globally provide a breakdown of their workforce by race and ethnicity on their own or to the public.

In addition to the challenges listed above, there is also a timing and frequency issue at which companies update their ESG information. On average, companies report updated metrics on a quarterly or yearly basis, which is too infrequent when the applications require a real-time analysis. In fact, according to a 2020 report released by the US Government Accountability Office (GAO), investors find that ESG disclosures “lack detail, consistency, and comparability.”

How banks can overcome the challenges

Although there are several challenges and complexities in setting up a robust ESG assessment framework, there are solutions to help banks and financial services organizations.

A foundational step is to address the data issue by assessing content beyond Corporate Social Responsibility (CSR), annual reports and sustainability reports. Ideally, banks want to include non-traditional sources such as global and local news, trade journals, social media, investor presentations, earning transcripts, surveys, reviews and other corporate filings.

By expanding the sources analyzed, it helps to address a number of other stated challenges. For example, we often find mentions in the news and various media outlets of social issues around a company . Additionally, we can now assess the company’s ESG practices with more frequently reported data. Finally, by expanding our data sources, we can potentially discover ESG information on both public and private companies that don’t have the teams in place to publish their disclosure.

While expanding the set of content sources is a great way to better understand an organization’s ESG practices, how can a bank actually do this without an army of analysts that can comb through all the data?

Advancements in AI and ML allow construction of ESG models

Thanks to recent advancements in AI and Machine Learning, we’re now able to construct models that can analyze large volumes of documents. The models can automatically identify, extract and quantify a company’s ESG practices — no army of analysts required.

Additionally, a good AI model should enable organizations to adapt its taxonomy. Banks will want to identify practices and controversies based on the specific lens they would like to employ for ESG Assessment.

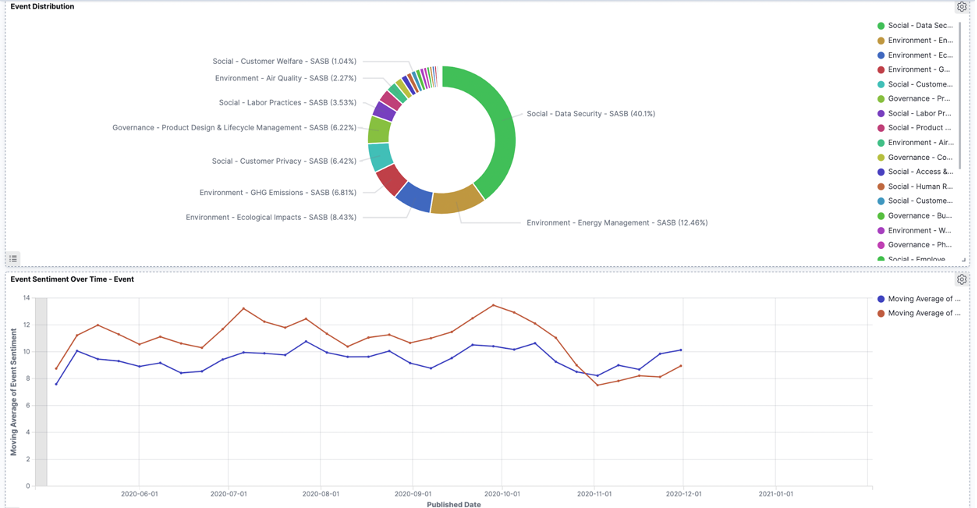

Finally, the output of the models can easily be visualized to help in the quick identification of areas of risk for an individual company, trends over time or a comparison to a peer group (see an example below, using the Accern platform. More information on Accern appears below.).

In conclusion

Using the latest AI/ML techniques, complex ESG data can now be utilized and intuitively incorporated into the deal structuring and pricing process. This will allow bankers to price deals using the latest ESG data during the pricing negotiation process. This shift will allow banks to originate deals with both credit risk and ESG risk in mind. Because this step is a key part of every banker’s focus, it’s also the most effective way to create ESG cultural awareness within banks.

Finally, considering recent events occurring globally, such as burning forests, rising shorelines, and even the Gamestop controversy, it’s clear that timely ESG data should be presented to the frontline. What more effective way to do this than by making it available as part of the pricing and commercial engagement process?

Learn more about the launch of the Brilliance DPXesg service.

For more about how to collect and incorporate ESG factors into your end to end process with Brilliance and Accern solutions, Contact Us.

About Accern

Accern enhances artificial intelligence (AI) workflows for financial services enterprises with a no-code AI platform. Researchers, business analysts, data science teams, and developers use Accern to build and deploy AI use cases powered by adaptive natural language processing (NLP) and forecasting features. The results are that companies cut costs, generate better risk and investment insights, and experience a 24x productivity gain with our smart insights. Allianz, IBM, and Jefferies are utilizing Accern to accelerate innovation. For more information on how we can accelerate artificial intelligence adoption for your organization, visit accern.com