Do you wonder how modernized your bank’s pricing process is – and what you might be missing?

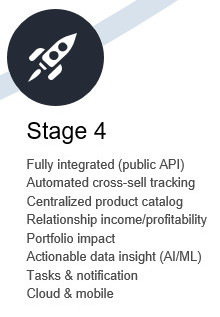

When I speak at conferences about digital pricing, I usually include a slide called “The Modernization of Pricing,” showing four stages of digital pricing transformation at banks. Stage I: the “Manual Process” is represented by the use of spreadsheets, repetitive data entry (inputting of customer data, look-up of risk rating, etc.), and manual data collection.

After my presentation, inevitably a few bankers will approach me and sheepishly advise, “I hate to admit it, but that’s us in Stage I . . .” Surprisingly, some of these banks are quite sizeable.

When you start automating your pricing process, your bank will enjoy tremendous competitive and bottom-line advantages. Here’s a walk-through of the four stages of the “Modernization of Pricing” to help you benchmark where you are.

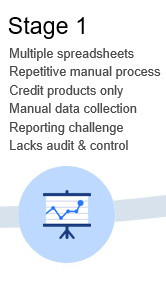

Stage I: “Manual Process”

Your loans are priced manually using one or more spreadsheets. There’s no consistency across products or regions. Your Relationship Managers (RMs) spend too much time inputting customer data, causing accuracy and consistency problems. You can’t price based on the entire customer relationship, so you focus on pricing credit products only. Cross-sell income is an after-thought.

That leads to the trilogy of pricing disasters: time-consuming manual data collection, reporting challenges, and lack of control and audit.

This is truly “in the dark” pricing. Your RMs have no benchmarks they can rely on. They can’t easily price based on overall customer profitability. Portfolio Managers can’t adequately shape the portfolio because there’s no transparency — they can’t optimize the use of the bank’s scarce capital. And accurate profitability forecasts are virtually impossible.

There’s no control of pricing – consistency and transparency aren’t there. Audits are time-consuming tasks of gathering emails and piecing together deal history.

Because the pricing process starts manually (with spreadsheets), it causes repetitive manual processes all along the way, leading to basis point leakage. You miss opportunities to make smarter deals and create more profitable customers. Portfolio Managers and Business Managers make less than optimal decisions because they don’t have reliable data.

The manual pricing process is dragging down your productivity, your profitability, and your competitiveness at every level.

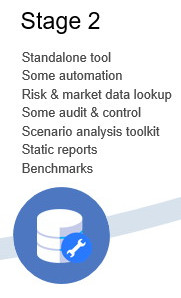

Stage II: “Stand-alone Pricing Tool”

You decide to take the first step into digital pricing with a standalone pricing tool for credit products. Your deals are now priced in the tool, giving you better control over the pricing model. There’s more pricing consistency across branches and regions, but not across business lines. Your RMs save time with customer risk and market data lookup.

RMs can run various scenarios to help analyze and construct better deals. You can actively manage to pricing targets, by setting hurdle rates or return on capital goals for credit products.

The pricing tool captures deal pricing for credit products, giving you better reporting. You enjoy improved transparency and consistency.

But audit is still time-consuming, because pricing approvals and decisions are still done manually and not fully recorded in the system. Cross sell income is still an afterthought — to justify why credit is priced under par. Relationship profitability analysis is still a back-of-the-envelope exercise.

The stand-alone solution still misses much of the data and system integration benefits of phases 3 and 4.

Stage III: “Automated Workflow”

RMs can now consider credit and non-credit products in your digital pricing tool. They get recommendations for different deal structures to optimize each deal. The same digital pricing tool is rolled out across different business lines.

Pricing approvals are automated to orchestrate and record every step in the approval process. Everyone involved in the pricing decision receives notifications by email to keep approvals moving. The automated workflow improves productivity and streamlines operations, making audit a seamless exercise. But advanced tracking of how pricing changed from the approved price to the booked price doesn’t appear in this phase.

Portfolio Managers and Management benefit from advanced analytics driven by consistent, accurate reporting on each deal. Margins improve because RMs and decision-makers have access to better customer profitability data across the bank.

While this phase delivers automation, it only automates pieces of the pricing task that are completed within the pricing tool. RMs don’t have the complete customer relationship easily accessible in one location, and can’t determine a new deal’s effect on customer profitability. And more advanced benefits – like cross-sell tracking – aren’t there.

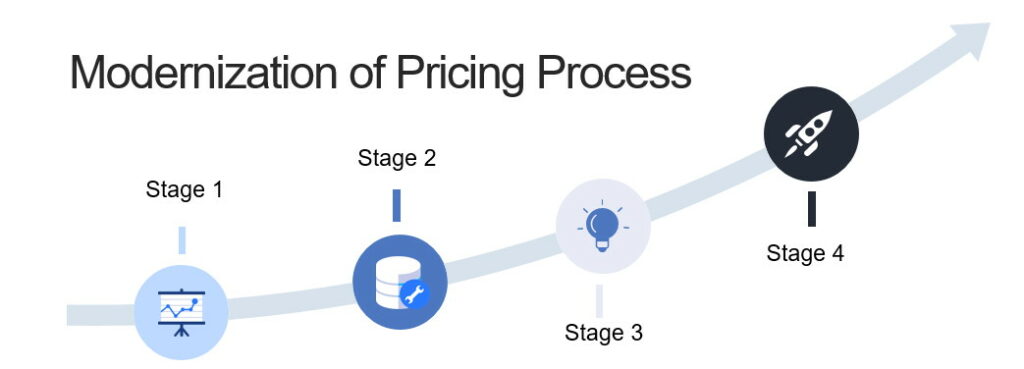

Stage IV: “End-to-End Integration for Customer Profitability”

With existing customer products integrated into your digital pricing tool, RMs see a forecast of existing relationship profitability. They can price new and reprice existing products to maximize overall relationship profitability.

Cross-sell promises are tracked automatically. Tasks and Notifications help RMs stay on track to deliver against these promises, along with other pricing collaboration efforts. Your digital pricing tool may incorporate Artificial Intelligence and Machine Learning for actionable data insights. Every deal is more easily optimized to help RMs achieve target risk-adjusted return and customer profitability.

The solution is fully integrated with your bank’s ecosystem via APIs. Your RMs might start the pricing process in a CRM (Customer Relationship Management) system, while their approved deals integrate with other in-house systems. Price changes are captured at every step of the way, including the final price logged into the booking system and data warehouse.

You can finally compare forecasted versus realized customer profitability through the integration of: existing customer products, cross-sell tracking, approval workflow, and API-enabled system integration. The entire pricing process is streamlined, because manual processes have been removed.

RMs have mobile access to the pricing tool, and have more time to build relationships.

Portfolio Managers consider the portfolio impact and multi-year effect of deals being proposed, so they can shape the portfolio in real time. Management can access accurate, interactive performance reports by RM, region, and business line.

In Stages III and IV, a bank begins to see significant improvements in operational efficiency, which drives increased margin and maximizes return on capital. Current digital pricing solutions deliver components of these later phases.

As margins continue to shrink, banks need to embrace automation and digital solutions that positively affect the bottom line. Moving out of the “Manual Process” of pricing into more automated digital solutions will help banks survive and thrive.